$UUUU OPEC’s Rift Impacts U.S. Energy Markets, Including Alternative

Oil prices are almost 40% higher than they began the year. Should the 5% dip over the past week be cause for concern among energy investors? Perhaps the reasons for the dip, impact on competition, and the U.S. production level ought to attract the most focus.

The volatility comes after an aborted meeting of OPEC+, the outcome of which was expected to result in an agreement to increase output, undoing 2020 cuts implemented as the economic lockdowns caused a worldwide glut of crude oil. Instead, OPEC+, which includes the original OPEC cartel members and their oil-producing allies, failed to reach an agreement.

Background:

In 2020 OPEC+ made the decision to severely slow production by nearly 10 million barrels a day as demand vanished from the impact of lockdown orders in economies both large and small. In 2021, the price of oil had risen as much as 50% to its high point as the world began relaxing COVID-era restrictions. Oil-exporting nations are now looking to orchestrate the way forward out of the pandemic crisis and into a world where world energy needs are expected to turn sharply away from petroleum.

The Agreement that Didn’t Happen

The expected agreement that would have increased world oil production fell apart because of a conflict between Saudi Arabia and the U.A.E. The U.A.E. asked to have its production target increased, this would have expanded its percentage of combined OPEC output. Increasing one country’s overall share has a tendency to create conflict. The cartel has stayed united with minimum open conflict, and they only act with a unanimous vote. The current outcome of “status quo” where the countries are expected to operate under the existing Covid era limited output will have the effect of keeping oil prices high but perhaps cut into potential revenue for the members involved.

U.S. Oil Prices vs. International

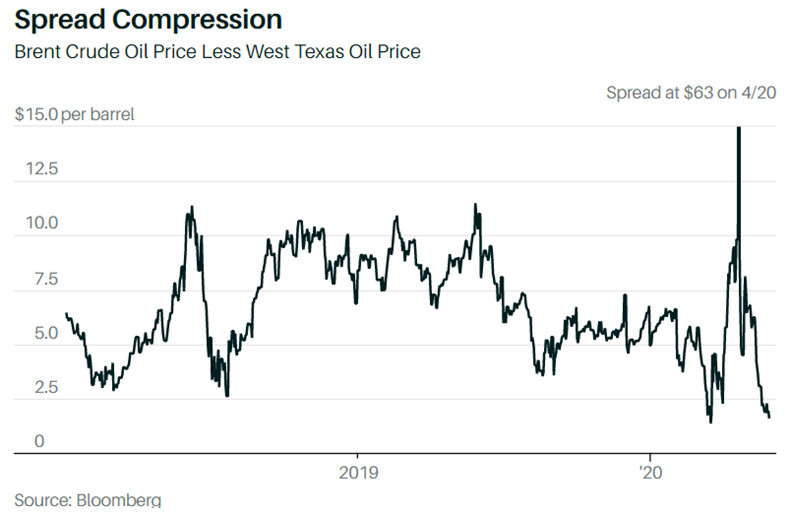

U.S. oil prices jumped and then declined yesterday (July 7) as traders deciphered and adjusted to the new OPEC outlook. Oil price volatility isn’t all that the markets experienced by the uncertain future. Oil spreads, the gap between international crude and U.S. production have narrowed. Producers globally benefit from higher prices. Downstream related business such as refiners prefer fat spreads between U.S. and non-domestic per barrel prices. The narrowing can be seen as a drag on some U.S. energy stocks.

Benchmark U.S. crude oil prices were up about 1% Wednesday morning (July 7), then turned sharply down about 2.6% by 10:40 a.m. E.S.T. Benchmark global crude prices began up about 0.8% before turning lower, dropping about 2.1%. West Texas Intermediate oil futures, the U.S. benchmark, are at $71.48 a barrel. Brent crude oil futures, the international benchmark, are at $72.95 a barrel.

Supply-demand factors in the U.S. are a driver of the spread compression. U.S. inventory post-Covid is at a massive deficit compared to normal levels. As the U.S. economy is sprinting out of last year’s poor economy, the rest of the world is crawling forward from the problems. Narrower spreads tend to reduce U.S. exports and invite imports. This dampens the potential for U.S. producers.

OPEC controls about one-third of global oil production. A rift between two rival countries could impact what occurs with energy sources that compete with oil and even help speed or slow movement away from petroleum. Competition between Gulf allies is heating up in other areas as well as the countries are working to diversify their revenue to be less reliant on oil as the move to reduce dependence accelerates. Increasing Petrodollars ($ U.S. dollars exchanged for crude) are important.

Take-Away

The rift between Saudi Arabia and the U.A.E. may widen or narrow. The countries are going through a challenging time where revising their economies for diversified income appears critical. The U.A.E. is ahead of the Saudis on this; financing additional economic revitalization projects increases the thirst for maximizing oil sales profit.

What occurs halfway across the world impacts the spread between U.S. crude and all other sources. When the spread narrows, other sources become more attractive than they had been. This can impact not just domestic oil sales but related businesses down the line, and even competing energy sources.

TraderPower Featured Companies

Top Small Cap Market News

- $SOBR InvestorNewsBreaks – SOBR Safe Inc. (NASDAQ: SOBR) Closes on $8.2M Private Placement

- $CLNN InvestorNewsBreaks – Clene Inc. (NASDAQ: CLNN) Announces Participation at Two Upcoming Investor Conferences

- $ATBHF Aston Bay Holdings Ltd. (TSX.V: BAY) (OTCQB: ATBHF) Releases Updated Report on Storm Copper Project Drilling Program

- $LGVN InvestorNewsBreaks – Longeveron Inc. (NASDAQ: LGVN) to Present at This Month’s Congenital Heart Surgeons’ Society Annual Meeting

- $LEXX InvestorNewsBreaks – Lexaria Bioscience Corp. (NASDAQ: LEXX) Begins Subject Dosing in Human Pilot Study #3 Evaluating Oral DehydraTECH-Processed Tirzepatide

- $FSTTF InvestorNewsBreaks – First Tellurium Corp. (CSE: FTEL) (OTC: FSTTF) Shares Additional Information on the PyroDelta Thermoelectric Generator, Relationship with Subsidiary

- $TMET.V Gold Stutters as Strong US Jobs Data Dampens Expectations of Large Rate Cuts

- $RFLXF JPMorgan Executive Says US Backlash Against ESG Is Exaggerated

- $SFWJ InvestorNewsBreaks – Software Effective Solutions Corp. (d/b/a MedCana) (SFWJ) Releases Report on Series of Acquisitions, Multiple Cannabis Licenses

- $EAWD IEA Hosts G20 Ministers, Influential Personalities to Discuss Clean and Affordable Energy Transition

Recent Posts

- $EAWD IEA Hosts G20 Ministers, Influential Personalities to Discuss Clean and Affordable Energy Transition

- $SFWJ InvestorNewsBreaks – Software Effective Solutions Corp. (d/b/a MedCana) (SFWJ) Releases Report on Series of Acquisitions, Multiple Cannabis Licenses

- $RFLXF JPMorgan Executive Says US Backlash Against ESG Is Exaggerated

- $TMET.V Gold Stutters as Strong US Jobs Data Dampens Expectations of Large Rate Cuts

- $FSTTF InvestorNewsBreaks – First Tellurium Corp. (CSE: FTEL) (OTC: FSTTF) Shares Additional Information on the PyroDelta Thermoelectric Generator, Relationship with Subsidiary

- $LEXX InvestorNewsBreaks – Lexaria Bioscience Corp. (NASDAQ: LEXX) Begins Subject Dosing in Human Pilot Study #3 Evaluating Oral DehydraTECH-Processed Tirzepatide

- $LGVN InvestorNewsBreaks – Longeveron Inc. (NASDAQ: LGVN) to Present at This Month’s Congenital Heart Surgeons’ Society Annual Meeting

- $ATBHF Aston Bay Holdings Ltd. (TSX.V: BAY) (OTCQB: ATBHF) Releases Updated Report on Storm Copper Project Drilling Program

Recent Comments

Archives

- October 2024

- January 2023

- June 2022

- December 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009