Now, a little-known company is trying to duplicate that feat.

TruTrace Technologies (CSE:TTT; OTC:TTTSF) is helping other companies “Amazonify” their businesses— creating a niche in the tech world that has yet to be filled.

In other words, it has no competitors yet.

As any retail firm knows, distribution is essential—it can be the biggest source of additional costs and the perfect place to improve efficiency.

Inefficiency can be a killer—a study from 2012 showed that distribution centers lose 3000 hours a year to unproductive workflow.

Lack of control over information costs even more—large businesses lost $47 million per year to inefficiencies in data transfer.

For any business to compete with companies like Amazon it all comes down to distribution—finding the best ways to pair products and markets.

But few businesses have the resources–the talent, technology, and budget–to compete with Amazon.

That’s where TruTrace Technologies comes in.

The company has developed a unique platform to help companies cut costs, streamline marketing and distribution procedures, and eliminate inefficiency in the supply chain.

It’s all about finding the best tech to fit the problem—and TruTrace Technologies (CSE:TTT; OTC:TTTSF) has built a sturdy platform that covers an entire industry’s supply chain, from top to bottom.

Plus, the company’s working in an exciting, rapidly growing new industry—cannabis.

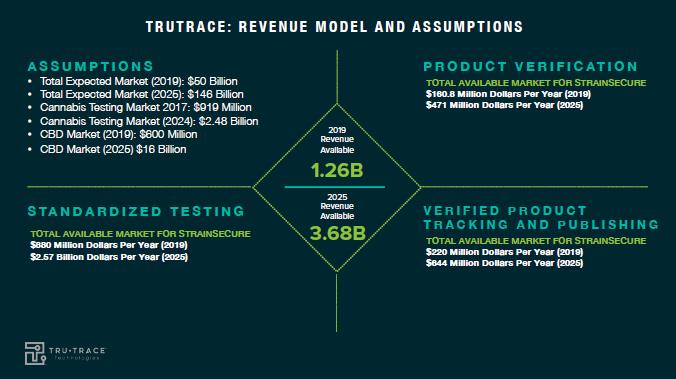

Cannabis produced $6 billion in deal values between 2015 and 2018.

Estimates peg the legal cannabis market at $66 billion by 2025.

But in reality, this tech could be applied to much bigger markets.

TruTrace Technologies (CSE:TTT; OTC:TTTSF) is breaking into cannabis, but it’s got the potential to take on much bigger markets—including retail groceries, which is currently dominated by big supermarket chains like Kroger Company ($105 billion) and H.E.B. ($21 billion).

Right now, it’s signed a new initiative with one of the biggest drug distributors in Canada—with more than 1200 brick-and-mortar stores.

The genius of TruTrace is simple—it’s taking tech solutions to the problems in supply chain.

And where other cannabis plays have focused on production—which firms have the most product, the lowest prices, the biggest chunk of market—TruTrace hopes to make a splash by tackling the issues surrounding the emergence of a new market—one that could be worth billions of dollars.

Why look at TruTrace? Here are a few reasons.

#1 From Top to Bottom

TruTrace doesn’t deal in products—it deals in information.

First, there’s the company’s indexing side:

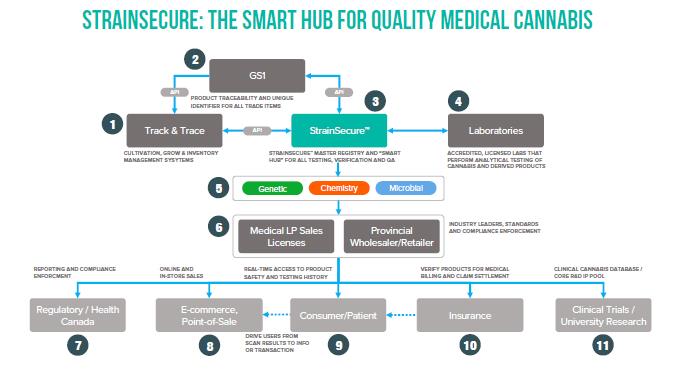

TruTrace Technologies (CSE:TTT; OTC:TTTSF) has built an incredible platform, allowing firms and users throughout the supply chain to search through a vast database.

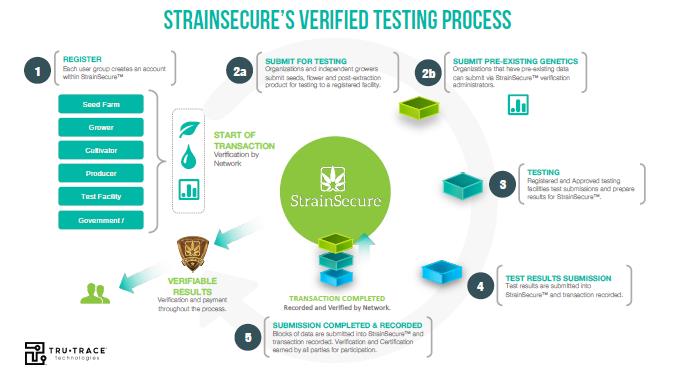

The indexing feature, which works through the company’s StrainSecure™ platform, allows any user to track a product from its origins to its destination—from development to production to transportation to retail.

This makes tracking the quality of products far easier. It also helps producers protect their IP—make sure no one else is duplicating their methods.

And there’s real demand for TruTrace’s services in the cannabis sector, where control of information is key.

A lot of it comes down to regulation.

Right now, every jurisdiction manages cannabis a little differently. The legal market is tightly regulated.

In California, for instance, there’s the California Cannabis Portal—a system for tracking changes in regulatory patterns that could affect California’s pot market—which will be worth $5 billion by 2020.

It’s no secret that companies and customers love this kind of service—it makes managing risks much easier, it protects the IP of different strains, and it makes sure there’s a leveled playing field, cutting out the black market.

But TruTrace is going one step further…

#2 The Power of the Blockchain

A lot of the news around blockchain two years ago was hype connected to the Bitcoin bubble—but that doesn’t mean there isn’t an immense opportunity in using blockchain technology.

There are at least fifty industries blockchain could change—and TruTrace (CSE:TTT; OTC:TTTSF) is getting a head-start.

In 2018, the company created an elegant software platform for tracking the origins and quality of different cannabis strains.

Known as Blockstrain, the system has now been taken to the next level.

TruTrace’s new and improved platform, StrainSecure™, uses sophisticated security protocols to collate and manage a vast store of cannabis data—from strain info to regulatory measures to consumer protection.

StrainSecure™ uses blockchain technology —a system for managing supply chains and cutting down on inefficiencies by allowing information to flow more freely through a network.

StrainSecure™ certifies and verifies all the information it collects, and protects it from tampering. The platform also serves regulators and customers by offering “genome to sale” breakdowns of every cannabis strain.

This protects IP while offering authorities and customers the chance to see exactly where each product originates, and what it can do.

It’s a “plug in and play” system, allowing users and firms to join the chain, which uses a linked network of users to ensure security of information, harnessing the computing power of every member to improve the strength of the system.

But that’s not all.

#3 Total Verification, Total Distribution

The StrainSecure platform provides all the information necessary for total verification of products passing through the supply chain.

That’s important for producers who want to protect their IP—particularly in the cannabis world where tracking a product’s origin point is crucially important to carving out a market share and warding off copy-cats.

StrainSecure offers visibility of key information—where each strain was developed, what each one does, possible uses, etc.—but also offers total transparency allowing for total verification.

But the StrainSecure formula also works to cut down the costs of distribution.

All retailers know that slow or inefficient distribution can cost big time—one study estimated inefficiencies could cost distributors $47 million per year in lost revenue.

Inefficiency can result in thousands of lost hours—but TruTrace is hoping to change that.

The company deploys the StrainSecure platforms for companies marketing CBD and other cannabis-adjacent medical products. The platform validates and verifies each company’s product, allowing the companies to match their products with needs all over the markets.

So total verification works hand-in-hand with total distribution.

By working through the StrainSecure platform, each company can verify their product passes through each stage of the supply chain. The service offers transparency and assurance for all who use it—improving trust within the cannabis industry and allowing producers to cut way down on distribution costs.

#4 Expand, Expand, Expand

This tech—the StrainSecure service—is LIVE.

TruTrace (CSE:TTT; OTC:TTTSF) has hit the ground running, and new revenues and partners could be just around the corner.

TruTrace’s different applications gives it multiple revenue streams—from exposure to the medical cannabis industry to helping companies throughout the cannabis supply chain connect with one another.

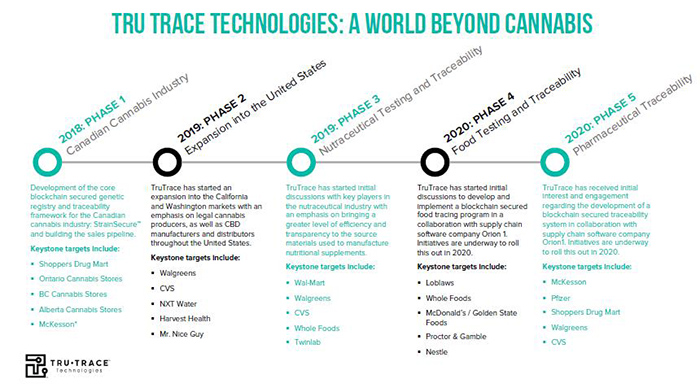

And there’s already an expansion plan in place.

First, TruTrace plans to cement its place in Canada, where cannabis is fully legal. Through StrainSecure™, the company hopes to construct a sales pipeline for cannabis products to major distributors.

From there, it hopes to move onward to the United States, where cannabis is regulated in more than a dozen states.

In California and Washington DC, where cannabis is decriminalized, TruTrace will target major distributors of CBD and cannabis products—including Walgreens and CVS; each reports more than $100 billion in sales per year.

TruTrace Technologies has its sights set on a world beyond cannabis—bringing its StrainSecure™ tech to markets adjacent to cannabis.

#5 Grow Baby, Grow

Where is TruTrace at right now?

Well, the company is flying way under the radar.

But buzz is starting to build.

StrainSecure™ has plans for expansion in 2019 and 2020.

And the company has just secured a huge opportunity.

TruTrace Technologies (CSE:TTT; OTC:TTTSF) stock jumped on the news that it had signed a deal with Shoppers Drug Mart, a major pharmacy chain in Canada. The company has 1300 stores throughout Canada and is a major name in pharmaceuticals.

This expansion is huge—it gives TruTrace a stable customer in a major market, and solidifies the company’s move away from cannabis into the retail game, with groceries and other major markets coming into view.

“This is a game-changing milestone that partners us with the most recognizable pharmaceutical brand in Canada,” said TruTrace Technologies CEO Robert Galarza.

And with the Shoppers Drug Mart deal in place, a lot more business could be just around the corner.

The stock has been stagnant, but catalysts could be coming—once the company expands access to StrainSecure™ and continues to grow the revenue stream.

TruTrace is sitting on ideas which could make a huge difference in a market that has only just begun its meteoric growth. And its tech—harnessing the power of the blockchain—has applications far beyond TruTrace’s current, relatively narrow base.

Things can only get better from here. Expect the price to potential jump even higher as the deal with Shoppes Drug Mart solidifies—perhaps from $0.20 to $0.30-35 and beyond.

Investors should take note.

Other companies looking to get a leg up in the cannabis race:

Namaste Technologies Inc (OTCMKTS: NXTTF) (TSX.V: N)

Through its subsidiaries, Namaste operates as a retailer of a variety of marijuana products, including vaporizers and other smoking accessories. The company sells its goods through e-commerce sites operating in 26 countries.

In addition to its accessory business, Namaste also engages in product development and the distribution of medical cannabis products in Canada.

Recently, Namaste, through its subsidiary Canmart Inc., entered into a supply agreement with Agra Flora to purchase and distribute up to 10% of Agra Flora’s massive Delta Greenhouse Complex at a price of $4 per gram.

The Green Organic Dutchman (OTCMKTS: TGODF) (TSX: TGOD)

The Green Organic Dutchman is primarily a research and development company focusing on cannabinoid-based products. Most of its products are dried organic cannabis, oils and edibles, but it also is involved in breeding plants to create new strains and distributing seeds for medical applications.

Recently, the Canada-based Dutchman announced a pivotal distribution partnership with HelloMD, a leading online medicinal cannabis company. The Dutchman will begin selling its premium organic product to HelloMD in late January for online distribution.

Andrew Pollock, Vice President of Marketing at the Dutchman, explained, “Patients deserve premium organic cannabis and through the partnership with HelloMD, we are pleased to provide increased access to TGOD’s product lines with the highest level of customer service and functionality to our patients.”

Molson Coors (NYSE: TAP) (TSX: TPX-A)

Molson Coors is an iconic multi-national beer company, with brands that are recognizable across the United States and Canada. Besides just its Molson and Coors lines, the company has also ventured into more niche beverages to take advantage of the growing craft beer market, buying up brands like Leinenkugel’s and Blue Moon.

Not to be left behind in the marijuana boom, Molson Coors is also developing a line of non-alcoholic cannabis-based beverages with its partner, the Hydropothecary Corporation.

Molson Coors Canada president and CEO Frederic Landtmeters noted, “While we remain a beer business at our core, we are excited to create a separate new venture with a trusted partner that will be a market leader in offering Canadian consumers new experiences with quality, reliable and consistent non-alcoholic, cannabis-infused beverages.”

Aurora Cannabis (NYSE:ACB) (TSX:ACB)

Aurora Cannabis is one of the biggest names in the burgeoning marijuana sector. With a market cap over $14 billion, Aurora has carved out its position as a leader in the industry. And the company is still making moves.

Recently, Aurora sealed a supply deal with Mexico’s Farmacias Magistrales SA, the country’s first and, for now, at least, only federally licensed importer of raw materials containing THC.

In an announcement from Aurora, the company stated that the deal “firmly establishes Aurora’s first-mover advantage in one of the world’s most populous countries, where more than 130 million people will have federally legal access to a range of Aurora’s non-flower medical cannabis products containing THC.”

Cronos Group (NASDAQ: CRON) (TSX: CRON)

Following its October slump, Cronos Group has seen a surge in trading volume, with a renewed investor interest in the company thanks to rumors surrounding the company’s discussions with tobacco giant Altria.

The Canadian firm, though primarily an equity investor, has made some major moves in recent years, wheeling and dealing with some of the hottest names in the sector. Because of its forward-thinking attitude, it has drawn the attention of many major mainstream players, including the company behind Marlboro, Altria Group.

On December 7th, rumors were finally confirmed when Cronos made the official announcement of a C$2.4 billion strategic investment from Altria. “Altria is the ideal partner for Cronos Group, providing the resources and expertise we need to meaningfully accelerate our strategic growth,” said Cronos Group’s Mike Gorenstein, Chairman, President and Chief Executive Officer.

By. Joao Piexe

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication should be viewed as a paid advertisement. Leacap Ltd and Safehaven and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher was not specifically paid for this communication. However, a related company was previously compensated by Tru Trace Technologies In May 2018, to produce and disseminate other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Safehaven will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ technology, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://Safehaven/terms-and-conditions If you do not agree to the Terms of Use http://Safehaven/terms-and-conditions, please contact Safehaven to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Safehaven is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.